A new company would like to build a $12 billion natural gas export terminal in Southeast Alaska waters near Prince Rupert, British Columbia. But some aren’t convinced the project will be viable.

The company is called AlaskCAN LNG. President Byng Giraud says his company hopes to capitalize on natural gas trapped in northern British Columbia.

“With the shale gas revolution, directional drilling and all those technological advances of the past 15 years, we’re awash with gas, and so that gas is looking for a market,” he said.

As more and more customers in Asia move away from coal, demand for B.C.’s gas is forecast to grow.

But shipping natural gas is complicated — in part, because it’s a gas. It’s not like shipping coal, or lumber or even oil. To ship natural gas efficiently, you need to cool it down until it condenses into a liquid. For that, you need something called a liquefaction plant.

“Which is essentially, to be simple, is a large refrigeration unit using the same physics as your refrigerator,” Giraud explained.

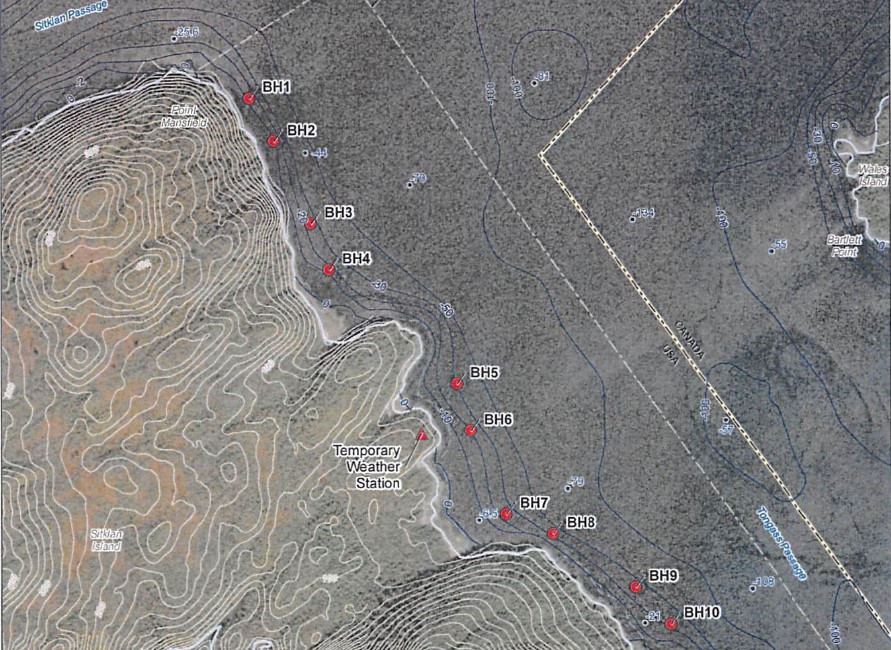

Giraud says his company is investigating sites in Southeast Alaska just over the border from B.C. The idea is to take the gas from northern B.C., liquefy it on a floating platform attached to a small island and put up to 12 million metric tons per year of liquefied natural gas on ships bound for Asia.

And Giraud says some of that gas could make its way into Southeast Alaska.

“Certainly could help a lot of Alaska communities and remote mining projects, that sort of thing, maybe switch from diesel to natural gas,” he said.

But why bother crossing an international border?

“We like the Alaska side, partially because it makes the pipeline shorter — saves about 60 kilometers. And Alaska has a fairly clear and robust permitting process,” Giraud said.

Which is to say, U.S. regulators have lots of experience permitting natural gas terminals.

But some experts say they don’t believe the hype.

Larry Persily is a professor at the University of Alaska Anchorage. He’s followed global gas markets for decades. He’s seen a number of projects try to capitalize on Asia’s growing demand for natural gas.

“I just think, oh, haven’t we heard this before?” he said.

Persily points to a proposed state-backed pipeline that would take gas from Prudhoe Bay to Southcentral Alaska for export to Asia. Various iterations of that idea have been studied for decades, but the project is now stalled amid skepticism from Gov. Mike Dunleavy’s administration.

Persily says one reason for that is that the necessary facilities are simply too expensive.

“The world’s always going to burn the cheapest gas it can get delivered to the dock. And that’s always been the challenge for Alaska,” he said. “And I think that will be a challenge facing this project, too.”

Early estimates from AlaskCAN LNG put the terminal’s cost at around $12 billion. And that doesn’t include the cost of the 12-mile pipeline. Persily says the economics just don’t make sense.

“The market is adequately supplied,” he said. “It doesn’t need another project at the moment.”

Persily points out that there’s another natural gas terminal under construction about 70 miles away in Kitimat, B.C.

Persily agrees with AlaskCAN that U.S. regulators know their way around gas terminals. Canada has only one high-volume terminal — that’s the one under construction in Kitimat. The U.S. has more than half a dozen online and under construction, mostly on the Gulf coast.

But Persily says Southeast Alaska is a whole different ballgame.

“Getting regulatory approval to build a hydrocarbon facility in Southeast Alaska is not going to be a slam dunk like it is in Houston,” he said.

He says community members might not be amenable to a new facility that would attract massive gas tankers to Southeast Alaska.

“I would think you’d have fishermen who’d say, I don’t care about natural gas. I’m fine with it,” Persily said. “But how many tankers are going to come through the water? What if a tanker has a spill?”

For his part, AlaskCAN LNG’s Byng Giraud doesn’t think the market is saturated. Oil giant Shell has a 40 percent stake in the Kitimat terminal. And they also own lots of wells in the northern B.C. gas fields.

“So yes, the LNG facility in Kitimat is going ahead, but that only really consumes Shell’s gas,” Giraud said. “So everybody else is looking for another facility.”

He says in this early part of the process, the company is just trying to determine whether a terminal is feasible.

“We’ll do a little geotech, we’ll do some wind and weather analysis to ensure that they actually are viable sites,” Giraud said. “This is where the community consultation element comes in. We talk to people and make sure we were doing something that’s right for everybody.”

And some locals sound positive on the issue: Ketchikan city mayor Bob Sivertsen said in a mid-December City Council meeting that a terminal near Prince Rupert could help the city transition away from diesel.

“Maybe in the winter, when we get short of power, we’d have natural gas to provide power and not run antiquated diesel engines and run up against air emissions issues,” he said. “So it’s an interesting thought.”

Gas expert Persily says it’d be almost as easy to ship that gas from the Kitimat terminal that’s already under construction.

Right now, AlaskCAN is still exploring its options. But if all goes according to plan, Giraud says the plant could come online in 2027 or 2028.

This story was produced as part of a collaboration between KRBD and Alaska’s Energy Desk.